Interbank Market

Uncollateralized call money transaction

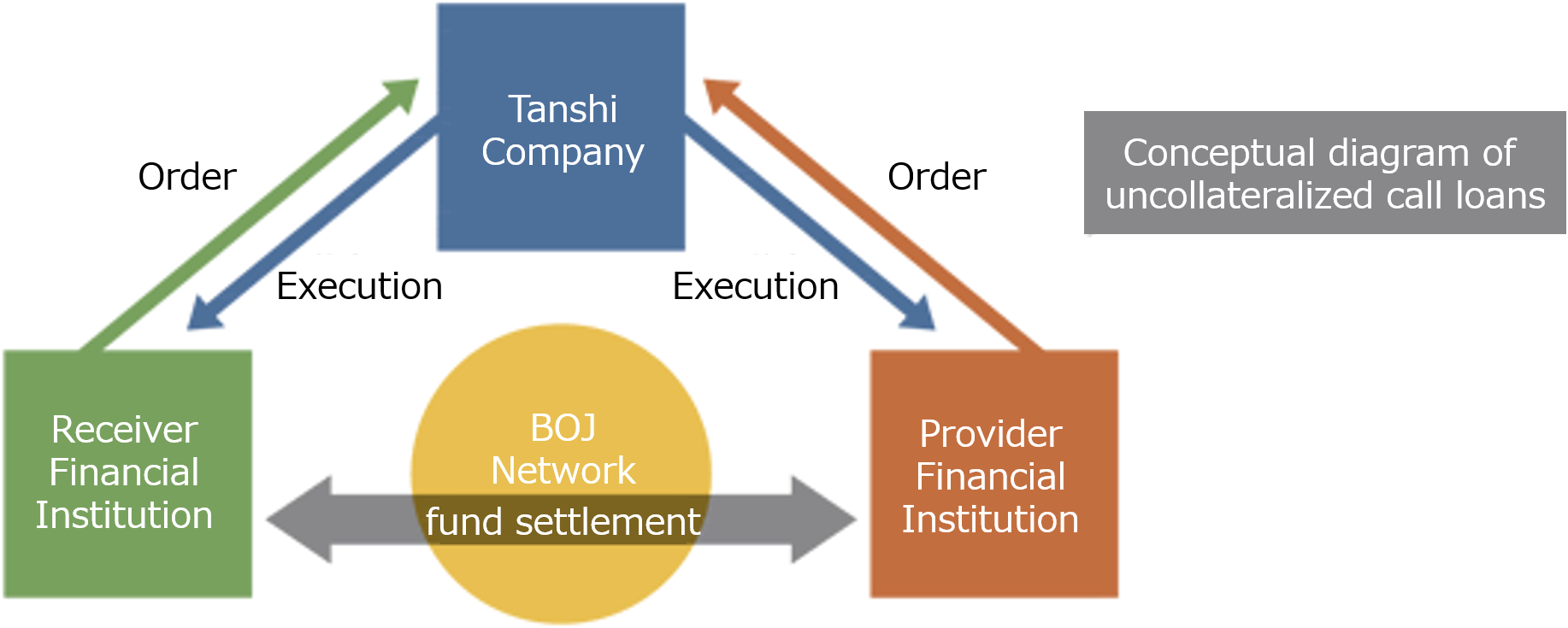

Introduced in 1985, uncollateralized call money transactions are extremely convenient as they do not require the transfer of collateral, and the volume of such transaction grew dramatically, reaching 35 trillion yen in 1995. Subsequent monetary easing resulted in the market contracting, and over the past couple of years, it has been 5-10 trillion yen. In the uncollateralized call loan market, money market brokers ascertain the intention of both lenders and borrowers of funds and facilitate transactions by serving as a broker. The transaction is settled directly between the two contracting parties. The rate on the uncollateralized call overnight instruments has long been used by the Bank of Japan as its target for monetary policy, and as a leading benchmark rate in the money market, its movement has a major impact on various financial markets, including the bond, stock, and foreign exchange markets.

Collateralized call money transaction

Collateralized call money transaction high credibility because they involve collateral such as government bonds, T-bills. There are two types of collateralized call money transactions: ones in which a market participant and money market broker are counterparties (dealing-type collateralized call loan transactions) and ones in which a money market broker only serves as a broker (broking-type collateralized call money transactions).

Intra-day call money transaction

Intra-day call money transactions are extremely short-terms loans that do not extend overnight but are settled within the day, and these transactions provide liquidity during the day. The transactions were introduced in 2001, the year interbank fund settlement was switched to real time gross settlement (RTGS). There are two types of these uncollateralized loans - dealing type, in which a money market broker is a counterparty, and broking type, in which the transaction does not involve the account of a money market broker.

Transactions involving the Bank of Japan

The Bank of Japan (BOJ) conducts operations using various measures in order to implement its monetary policy. The two main market operations are the "Funds-Supplying Operations against Pooled Collateral" and the "Sale of Bills". The Bank of Japan has used Tokyo Tanshi as one of the entities through which it conducts its operations, and thus Tokyo Tanshi contributes to BOJ operations.