1.Policy and Structure

Policy

Financial products are becoming increasingly diversified and complex as a result of financial liberalization, internationalization, and dramatic improvements in information technology.

Under these circumstances, Tokyo Tanshi has positioned risk management and compliance as one of its top management priorities in order to ensure sound management as broker in the short-term money market. With the goal of establishing a strict risk management and compliance system that takes into account the nature of its business and risk characteristics, Tokyo Tanshi has established internal rules, assigned appropriate human resources, and established management methods. Currently, Tokyo Tanshi is working diligently to enhance the sophistication of its management methods and strengthen its compliance system.

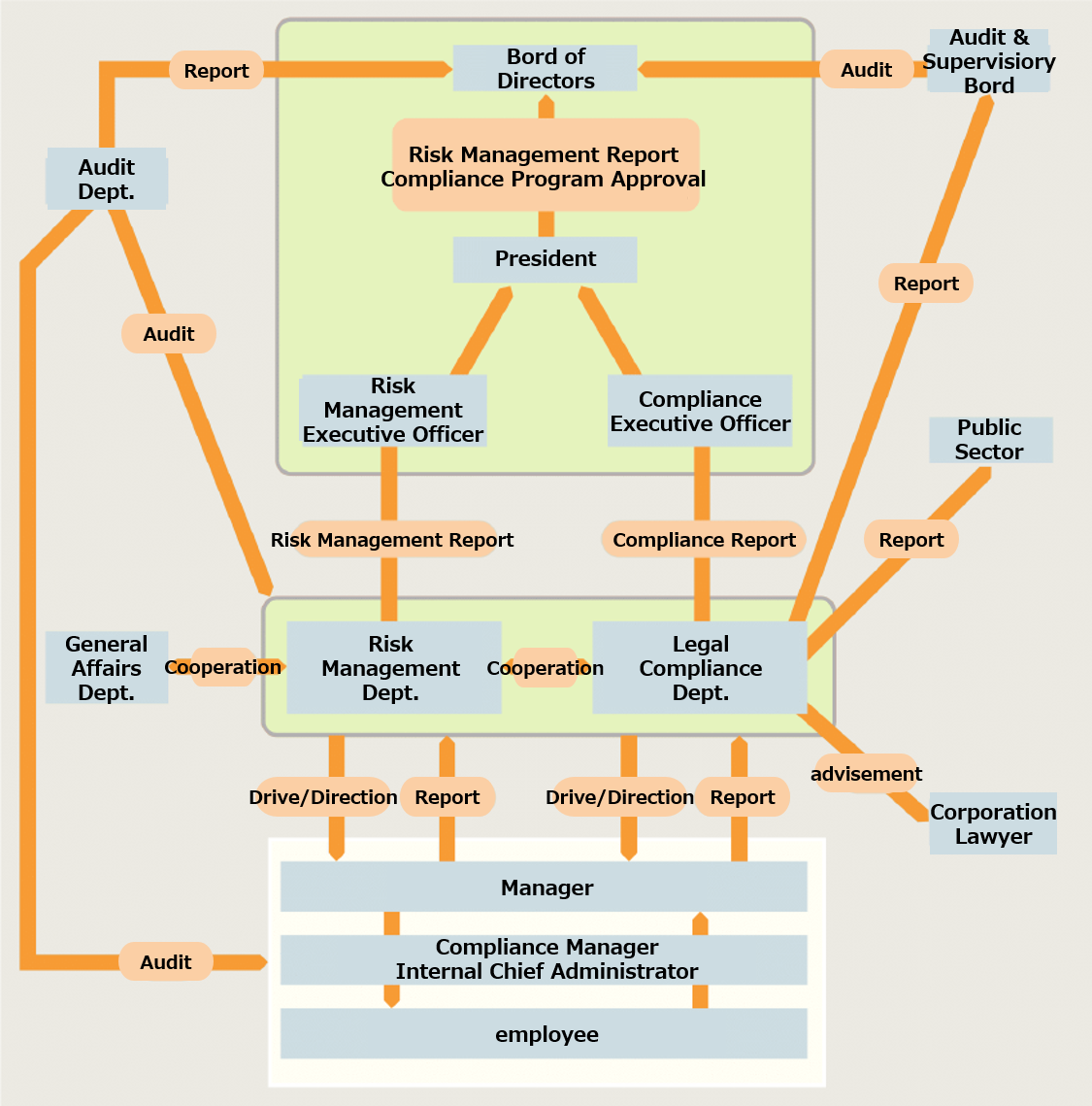

Structure

Tokyo Tanshi has established a Risk Management Department to oversee various risks and a Legal & Compliance Department to oversee compliance. This section not only monitors the daily risk status and compliance status, but also conducts planning, formulation, and operation related to risk management and compliance. The "Risk Management Department" and "Legal Compliance Department" are separated from the sales department to ensure their independence, and the "Audit Department" audits the appropriateness of risk management operations and compliance status, establishing a rigorous check system.

In addition, the ALM Committee, chaired by the President, has been established to monitor and forecast interest rate trends, confirm the current position, and deliberate on position strategies.

2.How to manage risk and compliance

Tokyo Tanshi has clarified rules on how to manage various risks related to the business in the "Risk Management Related Company Regulations," and the company measure and manage risks on a daily basis in accordance with these company regulations.

In addition, Tokyo Tanshi is in close contact with related departments, its group companies, and legal counsel to ensure that the company is able to respond appropriately to all risks that the company faces.

3.Calculation of Capital Adequacy Ratio

Tokyo Tanshi calculates its capital adequacy ratio in accordance with the standards under the Financial Instruments and Exchange Law and report it to the Bank of Japan. Tokyo Tanshi also emphasizes the capital adequacy ratio as an indicator to measure the soundness of the company.

4.Internal Management (Compliance) System

Tokyo Tanshi recognizes that compliance is an important management issue, and the company strives to build and thoroughly enforce corporate ethics in light of the social responsibilities of a money market broker based on the "Code of Conduct for Executives and Employees."

In addition, Tokyo Tanshi has established a compliance system through the establishment of "Compliance-related Company Regulations" and "Compliance Manual," the formulation of a "Compliance Program," and the appointment of a "Compliance Manager," to ensure that compliance is emphasized throughout the company.

5.Developing a Solicitation Policy for the Sale of Financial Products

The "Law Concerning Sales of Financial Instruments" which came into effect on April 1, 2001, requires a company who engages in the business of selling financial instruments to explain to customers the matters required by the Law when soliciting them for the sale of financial instruments, and to develop and publish a solicitation policy in advance. Because Tokyo Tanshi engages in the business of selling financial instrument as defined in the Law, the company has developed the policy.

6.Complaints and Other Matters

Internal department

For customer complaints, etc., regarding our operations under the Financial Instruments and Exchange Law, please contact the following and the sales department in charge.

Complaint Reception Department (Legal & Compliance Department)

【TEL】03-5200-2526

【Office Hours】Monday through Friday, 9:00 a.m. to 5:00 p.m. (excluding national holidays)

External Organizations

In addition to the internal contact mentioned above, we have taken measures such as using the Financial Instruments Mediation Assistance Center (FINMAC), a specified nonprofit corporation entrusted by the Japan Securities Dealers Association to assist in the resolution of complaints and disputes. Customers wishing to file a complaint should contact.

Financial Instruments Mediation Assistance Center (FINMAC)

【TEL】0120-64-5005

【Office Hours】Monday through Friday, 9:00 a.m. to 5:00 p.m. (excluding national holidays)

The Financial Instruments Mediation Assistance Center will ensure prompt and highly transparent processing from a fair and neutral standpoint.